– Increasing full-year 2021 EPS guidance range and announcing full-year 2022 EPS guidance range

– Executing five-year $32 billion capital program centered on the utilities

– Advancing Sempra Infrastructure platform, on track to close sale of 20% interest to KKR in the coming weeks

– Updating brand to align with infrastructure-focused strategy

SAN DIEGO, June 29, 2021 /PRNewswire/ — Today, Sempra’s (NYSE: SRE) (BMV: SRE) senior management team is providing an update on the company’s strategy, operations and financial outlook at its 2021 Virtual Investor Day.

“Over the next decade, we see the economies of North America becoming increasingly integrated,” said Jeffrey W. Martin, chairman and CEO of Sempra. “As a company, we are well positioned to build the critical energy infrastructure that will be needed to support new growth, while accelerating North America’s transition to cleaner forms of energy. Our competitive advantage lies in our enterprise-wide commitment to innovation, sustainability and leadership.”

Sempra’s three business platforms – Sempra California, Sempra Texas and Sempra Infrastructure – are strategically positioned in some of the largest economies in North America with a critical role in the energy future. The company’s strategic priorities are centered on executing a $32 billion capital plan, strengthening the balance sheet and returning value to shareholders. Sempra’s robust capital plan focuses on its utilities and provides strong visibility to future earnings growth.

Earnings Guidance

“In the last several years, we have realigned our portfolio with the objective of simplifying the business while improving our financial results – and it is paying dividends,” said Trevor Mihalik, executive vice president and chief financial officer for Sempra. “Today, the strength of Sempra’s balance sheet and a leading earnings growth profile bolster our mission to be North America’s premier energy infrastructure company.”

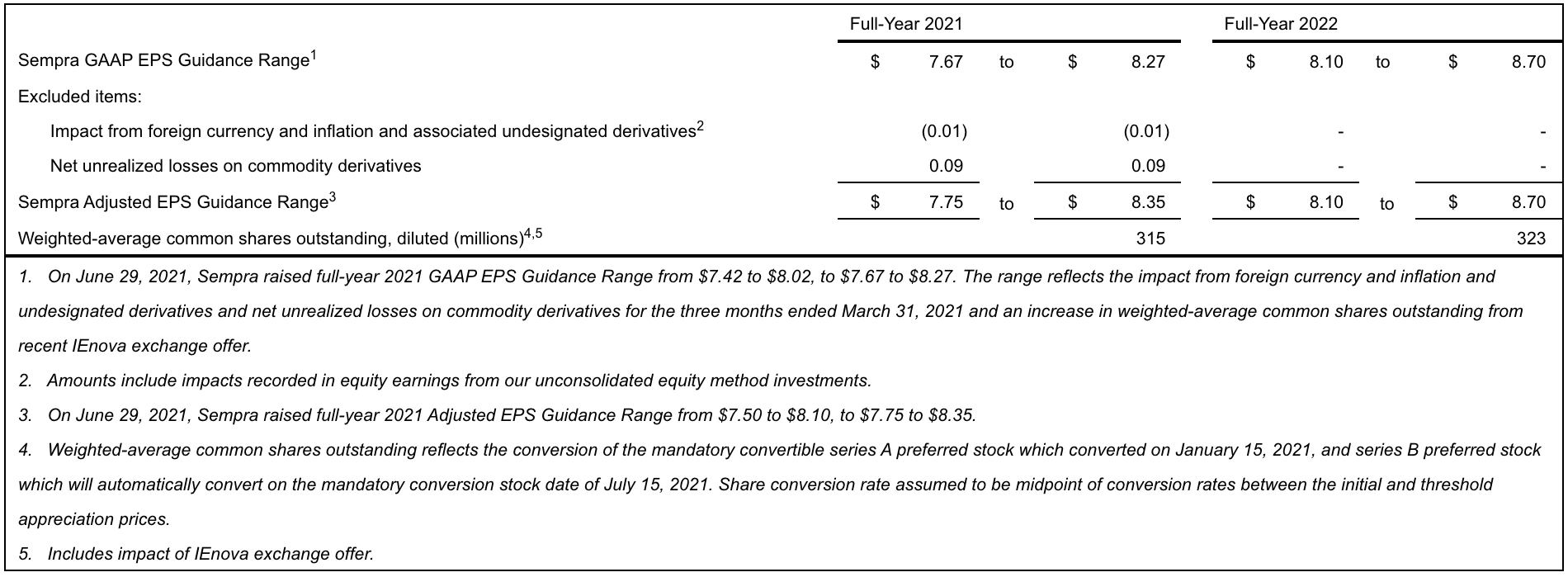

Sempra is increasing its full-year 2021 GAAP EPS guidance range to $7.67 to $8.27 and increasing its full-year 2021 adjusted EPS guidance range to $7.75 to $8.35. Sempra is also announcing its full-year 2022 EPS guidance range of $8.10 to $8.70.

Sempra California

Sempra’s California platform, San Diego Gas & Electric Co. (SDG&E) and Southern California Gas Co. (SoCalGas), are helping to decarbonize the state’s energy system, while working to provide safe, reliable and cleaner energy to approximately 26 million consumers. Recent operating highlights include:

- Received a decision at SDG&E and SoCalGas in their Petition for Modification of the 2019 General Rate Case (GRC) establishing attrition rates for 2022 and 2023. This decision supports the constructive outcomes of the GRC, which was based on the Risk Assessment Mitigation Phase process and the continued delivery of safe and reliable service to customers.

- Announced goals at SDG&E and SoCalGas to achieve net-zero GHG emissions by 2045 across emission scopes 1, 2 and 3.

Sempra Texas

Sempra’s Texas platform includes Oncor Electric Delivery Co. LLC (Oncor) and Sharyland Utilities whose businesses continue to modernize and extend their transmission and distribution networks to connect customers to cleaner sources of electricity. Supported by increasing population growth in the Dallas-Fort Worth area, Oncor has continued to grow its customer base anchored by a strong commitment to safety, reliability and operational excellence. Oncor’s recent operating highlights include:

- Added approximately 77,000 additional premises in 2020, the best organic growth for the company since 2007 and two times the national average.

- Achieved one of the highest safety records in the utility’s history.

- Delivered top quartile reliability in 2020, ahead of its 2022 goal.

Sempra Infrastructure

Sempra Infrastructure is well-positioned to advance growth opportunities by continuing to develop, build, and operate the energy systems of the future. The new business platform is expected to create increased shareholder value and provide an improved platform for innovation and potential new investments in renewables, hydrogen, green ammonia, energy storage and carbon sequestration.

Through a series of transactions announced last year, Sempra formed Sempra Infrastructure, a strategic growth platform with an implied enterprise value of approximately $25.2 billion, including expected asset-related debt of $8.37 billion. In April, Sempra announced that it had entered into a definitive agreement to sell a non-controlling 20% interest in Sempra Infrastructure to KKR for $3.37 billion in cash, subject to adjustments. The sale is expected to close in the coming weeks. Additionally, in May, Sempra announced the completion of its exchange offer to acquire the outstanding shares of IEnova (Infraestructura Energética Nova, S.A.B de C.V.) not owned by Sempra. Sempra’s ownership interest in IEnova increased to 96.4%, exceeding its initial target of 95% ownership of IEnova through the exchange offer.

Sempra Infrastructure continues to advance its liquefied natural gas (LNG) projects under development and in operation, with a view toward improving energy diversification in foreign markets and supporting the global energy transition.

Additionally, in Mexico, the company is currently operating and constructing approximately 1,000 megawatts of renewables projects with a development pipeline of nearly 3 gigawatts of cross-border solar, wind and battery projects.

Utilizing Technology and Innovation to Drive Energy Transition

The Sempra family of companies are focusing on the importance of innovation, technology and leadership to better serve customers, improve operational safety and efficiency, and support the modernization of energy systems. Notable examples over the past year include:

- SDG&E continued its top-tier wildfire mitigation efforts with a focus on innovation and weather science. The utility has invested more than $3 billion building a more wildfire resistant system, including implementing a robust weather network, using drone and satellite imaging for asset and vegetation management, and fire hardening its infrastructure assets.

- SoCalGas’ H2 Hydrogen Home is the first project of its kind in the U.S. demonstrating how carbon-free gas made from renewable electricity can be used in pure form (or as a blend) to fuel the clean energy systems of the future. The project was recently named one of Fast Company’s “World-Changing Ideas” in the North America category, which honors innovations for the good of society and the planet.

- Oncor inspects approximately 3,700 miles of electrical infrastructure each year with aerial technology capturing digital imagery to create 3D models of the transmission system to identify public safety concerns, component issues, property encroachments, and vegetation management issues.

Sempra Brand Updated to Reflect Infrastructure-Focused Strategy

Sempra has refreshed its brand to create better alignment with the company’s North American infrastructure strategy, including removing “Energy” from its wordmark. Modernizing the brand also supports the company’s vision to deliver energy with purpose, ideal of service to others and long-standing commitment to environmental stewardship.

Sempra’s new brand name will be effective with the New York Stock Exchange on July 2, 2021. The legal name of the company will continue to be Sempra Energy, doing business as Sempra. The company’s common stock will continue trading under the ticker symbol “SRE.”

Non-GAAP Financial Measure

This press release includes Sempra’s 2021 adjusted EPS guidance range, which is a non-GAAP financial measure. See the appendix for additional information regarding this non-GAAP financial measure.

About Sempra

Sempra’s mission is to be North America’s premier energy infrastructure company. The Sempra family of companies have more than 19,000 talented employees who deliver energy with purpose to over 36 million consumers. With more than $66 billion in total assets at the end of 2020, the San Diego-based company is the owner of one of the largest energy networks in North America serving some of the world’s leading economies. The company is helping to advance the global energy transition by enabling the delivery of lower-carbon energy solutions in each market it serves, including California, Texas, Mexico and the LNG export market. Sempra is consistently recognized as a leader in sustainable business practices and for its long-standing commitment to building a high-performing culture including safety, workforce development and training, and diversity and inclusion. Sempra is the only North American utility sector company included on the Dow Jones Sustainability World Index and was also named one of the “World’s Most Admired Companies” for 2021 by Fortune Magazine. For additional information about Sempra, please visit Sempra’s website at http://www.sempra.com and on Twitter @SempraEnergy.

This press release contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on assumptions with respect to the future, involve risks and uncertainties, and are not guarantees. Future results may differ materially from those expressed in any forward-looking statements. These forward-looking statements represent our estimates and assumptions only as of the date of this press release. We assume no obligation to update or revise any forward-looking statement as a result of new information, future events or other factors.

In this press release, forward-looking statements can be identified by words such as “believes,” “expects,” “anticipates,” “plans,” “estimates,” “projects,” “forecasts,” “should,” “could,” “would,” “will,” “confident,” “may,” “can,” “potential,” “possible,” “proposed,” “in process,” “under construction,” “in development,” “target,” “outlook,” “maintain,” “continue,” or similar expressions, or when we discuss our guidance, priorities, strategy, goals, vision, mission, opportunities, projections, intentions or expectations.

Factors, among others, that could cause actual results and events to differ materially from those described in any forward-looking statements include risks and uncertainties relating to: California wildfires, including the risks that we may be found liable for damages regardless of fault and that we may not be able to recover costs from insurance, the wildfire fund established by California Assembly Bill 1054 or in rates from customers; decisions, investigations, regulations, issuances or revocations of permits and other authorizations, renewals of franchises, and other actions by (i) the Comisión Federal de Electricidad, California Public Utilities Commission (CPUC), U.S. Department of Energy, Public Utility Commission of Texas, and other regulatory and governmental bodies and (ii) states, counties, cities and other jurisdictions in the U.S., Mexico and other countries in which we do business; the success of business development efforts, construction projects and major acquisitions and divestitures, including risks in (i) the ability to make a final investment decision, (ii) completing construction projects or other transactions on schedule and budget, (iii) the ability to realize anticipated benefits from any of these efforts if completed, and (iv) obtaining the consent of partners or other third parties; the resolution of civil and criminal litigation, regulatory inquiries, investigations and proceedings, and arbitrations, including, among others, those related to the natural gas leak at Southern California Gas Company’s (SoCalGas) Aliso Canyon natural gas storage facility; the impact of the COVID-19 pandemic on our capital projects, regulatory approval processes, supply chain, liquidity and execution of operations; actions by credit rating agencies to downgrade our credit ratings or to place those ratings on negative outlook and our ability to borrow on favorable terms and meet our substantial debt service obligations; actions to reduce or eliminate reliance on natural gas, including any deterioration of or increased uncertainty in the political or regulatory environment for local natural gas distribution companies operating in California, and the impact of volatility of oil prices on our businesses and development projects; weather, natural disasters, pandemics, accidents, equipment failures, explosions, acts of terrorism, computer system outages and other events that disrupt our operations, damage our facilities and systems, cause the release of harmful materials, cause fires and subject us to liability for property damage or personal injuries, fines and penalties, some of which may not be covered by insurance, may be disputed by insurers or may otherwise not be recoverable through regulatory mechanisms or may impact our ability to obtain satisfactory levels of affordable insurance; the availability of electric power and natural gas and natural gas storage capacity, including disruptions caused by failures in the transmission grid, limitations on the withdrawal of natural gas from storage facilities, and equipment failures; cybersecurity threats to the energy grid, the storage and pipeline infrastructure, the information and systems used to operate our businesses, and the confidentiality of our proprietary information and the personal information of our customers and employees; expropriation of assets, failure of foreign governments and state-owned entities to honor their contracts, and property disputes; the impact at San Diego Gas & Electric Company (SDG&E) on competitive customer rates and reliability due to the growth in distributed and local power generation, including from departing retail load resulting from customers transferring to Direct Access and Community Choice Aggregation, and the risk of nonrecovery for stranded assets and contractual obligations; Oncor Electric Delivery Company LLC’s (Oncor) ability to eliminate or reduce its quarterly dividends due to regulatory and governance requirements and commitments, including by actions of Oncor’s independent directors or a minority member director; volatility in foreign currency exchange, inflation and interest rates and commodity prices and our ability to effectively hedge these risks; changes in tax and trade policies, laws and regulations, including tariffs and revisions to international trade agreements that may increase our costs, reduce our competitiveness, or impair our ability to resolve trade disputes; and other uncertainties, some of which may be difficult to predict and are beyond our control.

These risks and uncertainties are further discussed in the reports that Sempra Energy has filed with the U.S. Securities and Exchange Commission (SEC). These reports are available through the EDGAR system free-of-charge on the SEC’s website, www.sec.gov, and on Sempra Energy’s website, www.sempra.com. Investors should not rely unduly on any forward-looking statements.

Sempra North American Infrastructure, Sempra LNG, Sempra Mexico, Sempra Texas Utilities, Oncor and Infraestructura Energética Nova, S.A.B. de C.V. (IEnova) are not the same companies as the California utilities, SDG&E or SoCalGas, and Sempra North American Infrastructure, Sempra LNG, Sempra Mexico, Sempra Texas Utilities, Oncor and IEnova are not regulated by the CPUC.

APPENDIX

RECONCILIATION OF SEMPRA 2021 ADJUSTED EPS GUIDANCE RANGE (Unaudited)

Sempra 2021 updated Adjusted EPS Guidance Range of $7.75 to $8.35 excludes items (after the effects of income taxes and, if applicable, noncontrolling interests) as follows:

- $3 million impact from foreign currency and inflation and associated undesignated derivatives for the three months ended March 31, 2021(1)

- $(29) million net unrealized losses on commodity derivatives for the three months ended March 31, 2021

Sempra 2021 Adjusted EPS Guidance Range is a non-GAAP financial measure (GAAP represents generally accepted accounting principles in the United States of America). This non-GAAP financial measure excludes the impact from foreign currency and inflation and associated undesignated derivatives and unrealized gains and losses on commodity derivatives, which we expect to occur in future periods, and which can vary significantly from one period to the next. Exclusion of these items is useful to management and investors because it provides a meaningful comparison of the performance of Sempra’s business operations to prior and future periods. Sempra 2021 Adjusted EPS Guidance Range should not be considered an alternative to Sempra 2021 GAAP EPS Guidance Range. Non-GAAP financial measures are supplementary information that should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP. The table below reconciles Sempra 2021 Adjusted EPS Guidance Range to Sempra 2021 GAAP EPS Guidance Range, which we consider to be the most directly comparable financial measure calculated in accordance with GAAP.

(1) Amounts include impacts recorded in equity earnings from our unconsolidated equity method investments.

SOURCE Sempra

For further information: Media, Paty O. Mitchell, [email protected], Twitter: @SempraLNGM; Financial, Lindsay Gartner, Sempra Energy, (877) 736-7727, [email protected]